The Evolution of Online Payments: From Barter Systems to Digital Wallets

The concept of exchanging goods and services has been ingrained in human society since ancient times, evolving over millennia to accommodate changing needs and technological advancements. From primitive barter systems to sophisticated digital wallets, the evolution of online payments has been a fascinating journey, reflecting the dynamic nature of commerce and human interaction. In this article, we’ll explore the rich history and transformative impact of online payments, tracing its evolution from humble beginnings to the digital age of today.

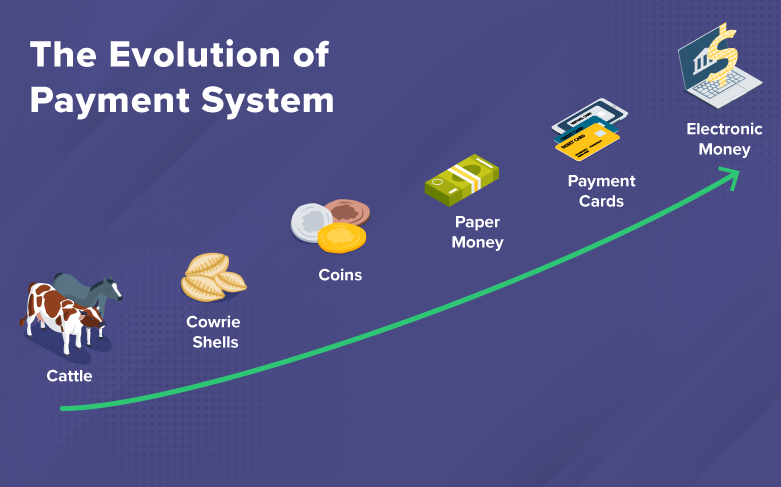

The roots of online payments can be traced back to the earliest forms of trade and commerce in ancient civilizations. In the absence of a standardized currency system, people relied on barter systems to exchange goods and services, trading items of value directly with one another. Whether it was livestock, crops, or precious metals, barter systems formed the foundation of early economic transactions, fostering trade and cooperation among communities.

As societies grew more complex and interconnected, the need for a standardized medium of exchange became increasingly apparent. The introduction of currency and coinage revolutionized commerce, providing a universally accepted unit of value that facilitated transactions across regions and cultures. From ancient coins minted by civilizations such as the Greeks and Romans to the paper currency introduced during the Middle Ages, the evolution of currency marked a significant milestone in the history of online payments.

The advent of the internet in the late 20th century heralded a new era of online payments, revolutionizing the way people transact and conduct business. With the proliferation of e-commerce platforms and digital marketplaces, consumers gained unprecedented access to goods and services from around the world. Online payment systems, such as debit cards and electronic funds transfers, became the preferred method of conducting transactions, offering convenience, security, and speed.

In recent years, the rise of digital wallets has further transformed the landscape of online payments, offering users a seamless and secure way to store and transact digital assets. Digital wallets, also known as e-wallets or mobile wallets, allow users to securely store payment information, such as debit card details and bank account numbers, on their electronic devices. With features such as one-click payments and peer-to-peer (P2P) transfers, digital wallets have become increasingly popular among consumers and businesses alike, driving the transition towards a cashless society.

In conclusion, the evolution of online payments reflects the ingenuity and adaptability of human civilization, from ancient barter systems to modern-day digital wallets. As we continue to embrace technology and innovation, the future of online payments is filled with exciting possibilities, shaping the way we conduct commerce and interact with one another in the digital age. By understanding the rich history and transformative impact of online payments, we can appreciate the journey that has brought us to where we are today and envision the boundless potential of tomorrow’s digital economy.